Thursday, July 5, 2012

The Real-World Middle Class Tax Rate: 75%

July 5, 2012

The Real-World Middle Class Tax Rate: 75%

Charles Hugh Smith

If we include all taxes, the real-world tax rate is much higher than the "official" income tax rate.

For those Americans earning between $34,500 and $106,000, the real-world middle class tax burden in high-tax locales is 15% + 25% + 5% + 15% + 15% = 75%. Yes, 75%.

Before you start listing the innumerable caveats and quibbles raised by any discussion of taxes, please hear me out first. Let's start by defining "taxes" as any fee that is mandated by law or legal necessity. In other words, taxes are what is not optional.

If we include all taxes, the real-world tax rate is much higher than the "official" income tax rate. These "other taxes" vary from nation to nation. France, for example, has a "television tax." It is mandatory, and since virtually every household has a TV this operates as a universal tax. The argument that this is "optional" is specious.

In every other advanced democracy, basic universal healthcare is paid by tax revenues. In the U.S., healthcare insurance is "optional" but this too is specious: in the real world, private healthcare insurance is mandatory because the alternative -- having zero insurance -- places your entire net worth and income at risk of catastrophic loss.

Having no healthcare insurance only makes sense if you have no real assets and a low income. At that point, your care will be provided by the taxpayer-funded Medicaid program, which is the default universal-care program in the U.S.

For this reason I consider the cost of private healthcare insurance in the U.S. the equivalent of a tax. We pay over $12,000 annually for barebones healthcare insurance, which amounts to about 15% of our gross income. Some countries pay for healthcare with a 15% tax, here we pay the 15% directly. There is no difference except the process of collecting the 15%. (The only real difference is that healthcare costs twice as much per person in the U.S. because the system is operated by cartels whose business model is fraud, opaque pricing and the elimination of competition via Central State regulation.)

Yes, the super-wealthy can absorb a $150,000 hospital bill, but the 99.9% cannot. Thus any claim that healthcare insurance is "optional" is specious.

Property tax is mandatory. Some countries have no property tax, others do. Once again, only counting social-insurance and income taxes as the "official tax rate" is horrendously misleading. For countries without property taxes, the revenues are collected as value-added taxes (VAT) or higher income taxes. One way or another, the services paid by property taxes in the U.S. are paid by other tax schemes in countries without property taxes. So property taxes must be included in any accounting of total taxes paid.

Many of us who reside in states such as Illinois, New York, New Jersey and California pay $12,000 or more annually in property taxes. That is about 15% of our household income.

Renters pay the property taxes indirectly, but to the degree that rents would be lower if property taxes were eliminated and the tax burden shifted to a VAT, then renters "pay" the tax just like property owners.

Employees looking at the paycheck stubs do not see the entire tax paid on their labor. Employees may wonder why their net pay has stagnated for decades. One reason is that the total compensation costs of employees has risen substantially.

To give but one example of many, Social Security taxes were once modest, 3% paid by the employee and 3% paid by the employer for a total of 6% of the wage. Now the total for Social Security (12.4%) and Medicare (2.9%) is 15.3%. Self-employed people pay the total 15.3% as "self-employment tax." This is the real-world tax burden of Social Security and Medicare.

The 15.3% Social Security/Medicare tax starts with dollar one of net income. The Social Security tax goes away above around $106,000 in income, the Medicare tax does not.

Most employees do not know how much healthcare insurance "tax" is paid by their employer. To the degree that wages would rise if the healthcare "tax" was not paid by employers, then employees pay for this "tax" indirectly. To act like it isn't a mandatory part of compensation costs is both specious and misleading.

The only transparent way to calculate the total tax burden is to count all taxes (or equivalent) paid by self-employed property owners. Not counting the indirect taxes of healthcare and property taxes is misleading to the point of blatant misrepresentation.

The basic Federal income tax gives each individual earner $9,500 in standard deductions and exemptions. The tax rate for all income above that is:

$1 to $8,500: 10%

$8,501 to $34,500: 15%

$34,501 to $83,600: 25%

$83,601 to $174,400: 28%

$174,401 to $379,150: 33%

Above $379,151: 35%

These rates are scheduled to rise at the end of 2012 unless Congress acts to maintain rates at current levels.

Many households have gigantic interest deductions stemming from gigantic mortgages, but let's set aside outsized debt-based tax deductions as far from universal.

Above a rather modest $34,600 in taxable income and up to around $106,000, the real-world middle class tax burden in high-tax American locales is 75%:

Social Security and Medicare: 15.3%

Federal income tax: 25% (28% above $83,600)

State income tax: 5% (mid-range)

Healthcare insurance: 15%

Property tax: 15%

15% + 25% + 5% + 15% + 15% = 75%

Clearly, the percentage of income devoted to healthcare insurance and property taxes declines as income rises. Someone earning $200,000 has not only dropped the 12.4% Social Security tax for income above $106,000, healthcare insurance and property taxes as a percentage of their income drops from about 30% for those earning around $86,000 to 15%.

We can argue fruitlessly about how many tax angels can dance on the head of a pin, but all the caveats and quibbles don't change the basic fact that real-world tax rate for the "middle class" earning more than $34,500 in taxable income in high-tax locales is a confiscatory 75%.

Please don't tell me the U.S. is a "low-tax" nation; I might suffer a breakdown that I couldn't afford due to exclusions in my "voluntary" healthcare coverage.

http://bit.ly/LRvHpr

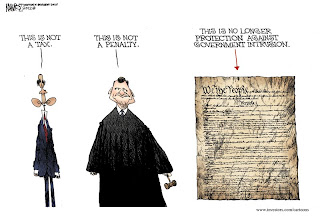

Liberal Logic: It’s Raining ObamaCare

|

--

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.

Obama’s Social Security Number Challenged in OH Court

|

--

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.

State Nullification: What Is It?

"Someone informs me that Walter Williams, filling in for Rush Limbaugh, just spent 30 minutes talking about nullification. Very good to hear. That is 30 minutes more than Rush himself has ever spent." -- Thomas E. Woods Jr.

![[]](http://assets.libertyclassroom.netdna-cdn.com/wp-content/themes/lc/images/lc_logo.png)

State Nullification: What Is It?

Tom Woods

What is it?

State nullification is the idea that the states can and must refuse to enforce unconstitutional federal laws.

Says Who?

Says Thomas Jefferson, among other distinguished Americans. His draft of the Kentucky Resolutions of 1798 first introduced the word "nullification" into American political life, and follow-up resolutions in 1799 employed Jefferson's formulation that "nullification…is the rightful remedy" when the federal government reaches beyond its constitutional powers. In the Virginia Resolutions of 1798, James Madison said the states were "duty bound to resist" when the federal government violated the Constitution.

But Jefferson didn't invent the idea. Federalist supporters of the Constitution at the Virginia ratifying convention of 1788 assured Virginians that they would be "exonerated" should the federal government attempt to impose "any supplementary condition" upon them – in other words, if it tried to exercise a power over and above the ones the states had delegated to it. Patrick Henry and later Jefferson himself elaborated on these safeguards that Virginians had been assured of at their ratifying convention.

What's the Argument for It?

Here's an extremely basic summary:

1) The states preceded the Union. The Declaration of Independence speaks of "free and independent states" that "have full power to levy war, conclude peace, contract alliances, establish commerce, and to do all other acts and things which independent states may of right do." The British acknowledged the independence not of a single blob, but of 13 states, which they proceeded to list one by one. Article II of the Articles of Confederation says the states "retain their sovereignty, freedom, and independence"; they must have enjoyed that sovereignty in the past in order for them to "retain" it in 1781 when the Articles were officially adopted. The ratification of the Constitution was accomplished not by a single, national vote, but by the individual ratifications of the various states, each assembled in convention.

2) In the American system no government is sovereign. The peoples of the states are the sovereigns. It is they who apportion powers between themselves, their state governments, and the federal government. In doing so they are not impairing their sovereignty in any way. To the contrary, they are exercising it.

3) Since the peoples of the states are the sovereigns, then when the federal government exercises a power of dubious constitutionality on a matter of great importance, it is they themselves who are the proper disputants, as they review whether their agent was intended to hold such a power. No other arrangement makes sense. No one asks his agent whether the agent has or should have such-and-such power. In other words, the very nature of sovereignty, and of the American system itself, is such that the sovereigns must retain the power to restrain the agent they themselves created. James Madison explains this clearly in the famous Virginia Report of 1800.

Why Do We Need It?

As Jefferson warned, if the federal government is allowed to hold a monopoly on determining the extent of its own powers, we have no right to be surprised when it keeps discovering new ones. If the federal government has the exclusive right to judge the extent of its own powers, it will continue to grow – regardless of elections, the separation of powers, and other much-touted limits on government power. In his Report of 1800, Madison reminded Virginians and Americans at large that the judicial branch was not infallible, and that some remedy must be found for those cases in which all three branches of the federal government exceed their constitutional limits.

Isn't This Ancient History?

Two dozen American states nullified the REAL ID Act of 2005. More than a dozen states have successfully defied the federal government over medical marijuana. Nullification initiatives of all kinds, involving the recent health care legislation, cap and trade, and the Second Amendment are popping up everywhere.

What's more, we've tried everything else. Nothing seems able to stop Leviathan's relentless march. We need to have recourse to every mechanism of defense Thomas Jefferson bequeathed to us, not just the ones that won't offend Katie Couric or MSNBC.

Won't This Make the New York Times Unhappy?

More proof it's a good idea.

Doesn't Nullification Violate the Constitution's Supremacy Clause?

Thomas Jefferson knew about the Supremacy Clause, it's safe to assume. The Supremacy Clause applies to constitutional laws, not unconstitutional ones. For a full reply to this objection, see Professor Brion McClanahan.

Isn't This Just a Smokescreen for Slavery?

Nullification was never used on behalf of slavery. As I show in Nullification, it was usedagainst slavery, which is why South Carolina's secession document cites it as a grievance justifying southern secession, and Jefferson Davis denounced it in his farewell address to the Senate. Thus Wisconsin's Supreme Court, backed up by the state legislature, declared the Fugitive Slave Act of 1850 unconstitutional (the mere existence of the fugitive-slave clause in the Constitution did not, in its view, suffice to make all the odious provisions of that act constitutionally legitimate). In Ableman v. Booth (1859), the Supreme Court scolded it for doing so. In other words, modern anti-nullification jurisprudence has its roots in the Supreme Court's declarations in support of the Fugitive Slave Act. Who's defending slavery here?

How Can I Learn More?

The indispensable source for developments connected to nullification and the Tenth Amendment is TenthAmendmentCenter.com. Its Legislative Tracking page covers a variety of nullification initiatives and tracks their progress in state legislatures across the country.

My new book, Nullification: How to Resist Federal Tyranny in the 21st Century, makes the historical, constitutional, and moral case for nullification. Read a free chapter.

Be sure to read my essay "Nullification: Answering the Objections."

And check out what happens when a Princeton professor shoots off his mouth on nullification without knowing anything about the subject.

Nullification is an important defense mechanism for a free people, with deep roots in American history – albeit American history no one is taught in school. Learn more about it, and join the cause.

http://www.youtube.com/watch?v=hxxJYbZktyQ&feature=player_embedded

http://www.youtube.com/watch?feature=player_embedded&v=TrcM5exDxcc

http://www.youtube.com/watch?feature=player_embedded&v=6J8QrErfbvA

Want to unlearn the propaganda we got in school, and at last be taught real history and economics? Liberty Classroom, founded by bestselling author Tom Woods, offers on-demand, downloadable courses in sound economics as well as U.S. and European history, taught by professors who share your commitment to liberty. Learn in your car, a little each day, and make yourself a formidable debater for the cause of freedom. Find out more!

http://www.libertyclassroom.com/nullification/

**JP** Fw: SHARE WITH OTHER

You received this message because you are subscribed to the Google

Groups "JoinPakistan" group.

You all are invited to come and share your information with other group members.

To post to this group, send email to joinpakistan@googlegroups.com

For more options, visit this group at

http://groups.google.com.pk/group/joinpakistan?hl=en?hl=en

You can also visit our blog site : www.joinpakistan.blogspot.com &

on facebook http://www.facebook.com/pages/Join-Pakistan/125610937483197

Pics and toons 7/5/12 (6)

--

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.

Pics and toons 7/5/12 (4)

--

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.

Pics and toons 7/5/12 (3)

--

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.

Pics and toons 7/5/12 (2)

--

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.