Jon Chait Watch: Libertarian "Vacuity" on Budget, Taxes, Once Again Causes Liberal Pundit to Erupt!

In my mind, I picture Jon Chait of The New Republic as the Gale Gordon of the liberal punditocracy (full disclosure: Chait, whom I've met a few times, looks nothing like Gale Gordon). As the hapless Mr. Mooney on The Lucy Show, Gordon was the perpetually put-upon straight man whose eye-rolling and ribs-elbowing were never recognized by a single other human being, including the audience. The comic result: The gold standard of slow burns giving rise to comic eruptions that at least one other Reason stafferfinds memorable enough to mention with semi-disturbing regularity.

In my mind, I picture Jon Chait of The New Republic as the Gale Gordon of the liberal punditocracy (full disclosure: Chait, whom I've met a few times, looks nothing like Gale Gordon). As the hapless Mr. Mooney on The Lucy Show, Gordon was the perpetually put-upon straight man whose eye-rolling and ribs-elbowing were never recognized by a single other human being, including the audience. The comic result: The gold standard of slow burns giving rise to comic eruptions that at least one other Reason stafferfinds memorable enough to mention with semi-disturbing regularity.

Not long ago, Chait accused me of being a conservative dupe after I wrote a post about how the massive spending increases under George W. Bush deserved credit for massive deficits rather than his evil tax giveaways to billionaires who light their cigars with cardboard ripped from the very appliance boxes that all middle-class people (defined as everyone making less than $200,000) are now forced to live in. I even cleverly titled my piece " "Why is everyone picking on the 'Bush tax cuts' rather than the 'Bush spending increases'?" You can read Chait's response and my rejoinder by going here and working backwards.

Woops, I've done it again, says Chait, with the Reason.tv video "Budget Chef Explains How to Balance the Budget W/O Raising Taxes." Let's take a look. It's about two minutes, so why don't you grab a nice cup of coffee or take another hit of salvia. (Happy birthday, Miley! Call me when you need help injecting heroin directly into your eyes).

Chait correctly notes that the video is based on a piece I coauthored with Reason columnist andMercatus Center economist Veronique de Rugy (a Chait bete noire who, like me, exemplifies in his mind the dread curse of "libertarian sanctimony." Read our piece, "How to balance the budget without raising taxes" by clicking here.

The video and article are my and Veronique's answers to the challenge that President Barack Obama threw down to his Commission on Fiscal Responsibility and Reform: balance the budget by 2020. The comission, headed by Erskine Bowles and Alan Simpson, offered up a bunch of spending cuts and tax increases to cover the bill in a mathematically unconvincing way. In particular, they rely on levels of revenue that have never been achieved by the feds (21 percent of GDP and higher). The same goes for most of the other budget plans floating around out there. And incidentally, I look forward to the milk cartons containing pictures of Bowles and Simpson, who, along with their recommendations, will never be heard from again.

Using the Congressional Budget Office's alternative scenario figures, which assume continuation of the Bush tax cuts and continuing fixes to the AMT, CBO says that federal revenue will rebound over the next several years to about 19 percent of GDP. So Veronique and I took as a given that, if we want a balanced budget, the feds cannot spend more than 19 percent of projected GDP in 2020. The feds have been spending significantly more than that for years, so the budget-cutting question becomes, How do you get there from here over the next 10 budgets?

In the video, Gillespie chirps, "it's so incredibly simple that virtually any elected official should be able to pull it off." The hook is that, under their plan, "you only need to trim 3.6% of each year's budget."

Gillespie displays a piece of pork, which symbolizes the federal budget, divided into ten slices, representing each of the next ten years. He trims a tiny bit of fat off each slice ("all we need to do is cut this little piece of fat right here.") Voila!

But, of course, the visual is completely misleading. He is representing a plan to cut 3.6% of the budget every year. His actual plan is to cut 3.6% the first year, then another 3.6% the next year, then another 3.6% the following year, and so on....

The specific claim that you only need to cut 3.6% of the budget, and the broader claim that you just need to trim a little bit of fat here and there, are utterly false. The idea that the budget can be balanced without any increase in tax revenues and without imposing substantial pain is one of the most debilitating pathologies of right-wing thought.

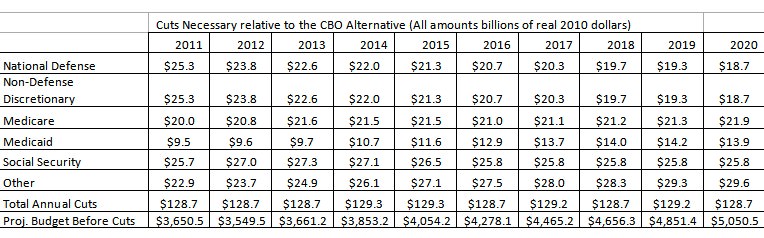

While the Warner Wolf in me wants to say "Let's go to the videotape" (watch above!), let's instead look at the main figure from the piece Veronique and I wrote. This lays out, in pretty clear detail I think, how you can make small, systematic cuts to bring projected total federal outlays in 2020 into line with 19 percent of expected GDP (the amount the CBO says will be in play).

In the above, we lay out what 3.6 percent annual cuts in each of the next 10 budgets would come to if applied across the board to major spending areas (note that debt payments are included in the "other" category).

Here's something that non-libertarians might want to consider. Over the past 70 years, the feds have not succeeded in generally jacking up the amount of revenue as a percentage of GDP (thank you, AOL's John Merline, for this essential insight). The average is in fact slighly below 18 percent, so by using 19 percent (the CBO's number, which is consistent with Hauser's Law), we're even giving DC some slack. If balancing the budget is a good thing, and reality exists, you're going to have to find some way to introduce the two to one another for the long haul, if not a shotgun wedding.

The feds have managed to increase revenue to over 20 percent of GDP every once in a while (Bill Clinton managed it, for instance, but balanced the budget by significantly cutting spending as a percentage of GDP), but they have not proven able to do so for any length of time. You can bitch and moan about that all you want - that it's politics or business cycles or whatever - but until you come up with a feasible way of pushing revenue up and up for the long haul, you're shit out of luck. And the country will be stuck with the mother of all unpayable bar tabs.

But that's just the vacuous libertarian in me talking, I guess.

Here's some more Chait:

I'm sure they could find at least $1.3 trillion in spending [over the next decade] that they don't like. But the point is that you would have to eliminate a lot of functions of the federal government, and/or reduce a lot of social benefits.

First off, don't forget that the $1.3 trillion that we're talking about cutting over the next decade comes out of budgets that are projected to increase every year from 2012 on (see above) and that total federal spending over the next decade will come to over $42 trillion. I wonder if Chait is willing to name anyfunctions of the federal government that he thinks we can live without? Maybe the two ongoing wars that his magazine happily supported (at least until recently). Maybe the Medicare prescription drug benefit, which gives relatively wealthy seniors free or reduced-price drugs regardless of ability to pay? Indeed, why not take a longer look at Medicare in toto, a program that former Obama adviser Christina Romer has said wastes 30 percent of its funds?

Or to put it slightly differently, could you find that much dough from the last decade's spending you'd like to cut? The Aughts have not been kind to spending hawks, that's for sure. Since Bill Clinton wrote his last budget, total federal outlays have increased by about 60 percent in 2010 dollars. As this web site is never to slow to point out (the same goes for Veronique everywhere else she writes), that is a bipartisan disaster.

I could go on, but for the purposes of our exercise, Veronique and I didn't single out specific programs (though we'll suggest some in a forthcoming article-length piece in Reason magazine). The point was to show how the federal budget could be brought into balance in 2020 per Obama's dictate.

But there's one more thing to consider. Bouncing off the budget argument, Chait says that de Rugy, who blogs at National Review's The Corner and is regularly pilloried there for showing how rotten on spending the GOP is, is wrong, wrong, wrong, about the effect of the Bush tax cuts because she is, you know, a blind, one-eyed ideologue who as a libertarian is alas a dupe of hate-the-poor conservatives who stay forever young by shooting their hunting partners in the face.

As it happens, the other day, Veronique posted on the same data from the Tax Foundation that I had.The data show that, contra many of the claims emanating from such Democratic Party bit players as Joe Biden and Hilary Clinton, top earners actually paid larger shares of total income taxes under Bush than Bill Clinton. Here's my quick gloss on that:

In 2000, for instance, the top 1 percent of income earners paid 37.42 percent of all income taxes collected. In 2008, they paid 38.02 percent. That's down a bit from the peak of 2007 and reflects the recession hitting. The bottom 50 percent of filers saw their share of the income tax burden fall from 3.91 percent to 2.7 percent.

That sort of thing just isn't good enough for Chait, who must insist, once again against reality, that

The real story here is that the proportion of pre-tax income earned by the top 1% has been rising since the late 1970s. The rich paid a higher share of the tax burden in 2008 than in 2001 because they earned a higher share of the income. If de Rugy was right that the Bush tax cuts caused the rich to pay a higher share of the taxes, then the share of the taxes paid by the rich should have fallen during the Clinton era. In fact the opposite occurred.

You got that? Yes, it's true that the wealthy have been getting a bigger share of income growth for a long time. Nobody disputes that (and indeed, I pointed out as much in my post). But Chait then goes into a "does not compute" spasm: The rich couldn't be paying a higher share under Bush because... because... because... because...

You got that? Yes, it's true that the wealthy have been getting a bigger share of income growth for a long time. Nobody disputes that (and indeed, I pointed out as much in my post). But Chait then goes into a "does not compute" spasm: The rich couldn't be paying a higher share under Bush because... because... because... because...

Oh Gale Gordon, oh humanity!

But the rich were paying a bigger share, and what Veronique pointed out was that "the main impact the rate reduction had in the first place was to make the rich pay an even bigger share of taxes that they paid before."

You can argue that the projected $70 billion a year that won't clang in federal coffers over the next couple of years by extending the Bush tax rates is a tragedy because, I don't know, we need to keep waging war in Afghanistan or buying obsolete weapons systems or bailing out big banks or repaving highways and extending stimulus funds that have worked out so well.

But in the name of all that's holy - and in loving memory of Gale Gordon - can some of us take a few quick deep breaths?

Update: Chait responded to this and my final response (promise) can be read here.

Thanks for being part of "PoliticalForum" at Google Groups.

For options & help see http://groups.google.com/group/PoliticalForum

* Visit our other community at http://www.PoliticalForum.com/

* It's active and moderated. Register and vote in our polls.

* Read the latest breaking news, and more.

No comments:

Post a Comment